This page complements our FY24 Sustainability Report, which demonstrates our leadership in the transformation of food systems, highlights the value we deliver to customers and wider society, and showcases our sustainability progress and achievements in the past year. The report was prepared using the European Sustainability Reporting Standards (ESRS) to structure our sustainability statements and to provide an overview of Tetra Pak's sustainability performance for the period 1 January 2024 - 31 December 2024.

*Where FY is mentioned, it refers to Full Year.

Find our FY24 Sustainability Report here

Sustainability performance ratings

The CDP assesses data from over 22,000 companies, ranking them on their transparency, tangible action and environmental leadership. Based on data reported through CDP’s 2024 climate change questionnaires, we were among the small number of companies that achieved an 'A' score. EcoVadis evaluates companies’ sustainability performance across four pillars: Environment, Labour & Human Rights, Ethics and Sustainable Procurement. Our 2024 score places us in the top 1% of companies assessed by EcoVadis in our category and among the top 5% of all companies assessed by EcoVadis in the same period.

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| CDP | |||

| Climate | A | A- | A |

| Forests | A | A | A- |

| Water | - | A- | A- |

| EcoVadis | Gold Medal | Gold Medal | Gold Medal |

FOOD SYSTEMS

Food Production

Food systems are complex and transformation requires a systems approach. To enable this, we have developed four food systems pathways: enable the transition to more sustainable dairy, innovate for new food sources, reduce food loss and waste and scale access to safe nutrition through sustainable food packaging.

Here is some the data to show progress we’ve made in 2024.

| 2022 | 2023 | 2024 | ∆% 2024 vs 2023 | 2030 target (baseline) | |

|---|---|---|---|---|---|

| Food production | |||||

| Cumulative number of smallholder farmers involved in Dairy Hub Projects since 2011 | 65,880 | 77,376 | 83,967 | 9% | 100,000 (2011) |

| Cumulative number of Dairy Hub Projects since implementation in 2011 | 22 | 25 | 29 | 16% | |

| Absolute GHG emission reduction of dairy ambient processing lines (tCO2e) since 2019 baseline | -32% | -33% | -42% | -13% | -50% (2019) |

| % of progress towards sales target of plant-based and new-food1 processing equipment and technologies vs 2023 baseline | N/A | 0 | 18.1% | - | Triple (2023) |

| Food access | |||||

| Number of children reached by School Feeding Programmes worldwide (million) | 66 | 64 | 66 | 3% | |

| Number of countries participating in School Feeding Programmes worldwide | 44 | 49 | 49 | 0% |

1 'New food sources' is a term broadly referring to any food produced through a combination of new ingredients or innovative new processes. It includes, but is not limited to, the EU definition of 'novel foods' in EU Regulation 2015/2283 on novel foods.

CIRCULARITY

Our ambition is to drive circular solutions by designing our packaging, equipment and services in a way that reduces material use, avoids waste, improves recyclability and extends lifespan.

See below how we've progressed in this area in 2024.

Resource inflows

Our cartons are recyclable where collection, sorting and recycling infrastructure exists at scale. By increasing the fibre content and reducing the plastics and aluminium, our packaging becomes more attractive to paper mills and fibre recycles, and easier to recycle.

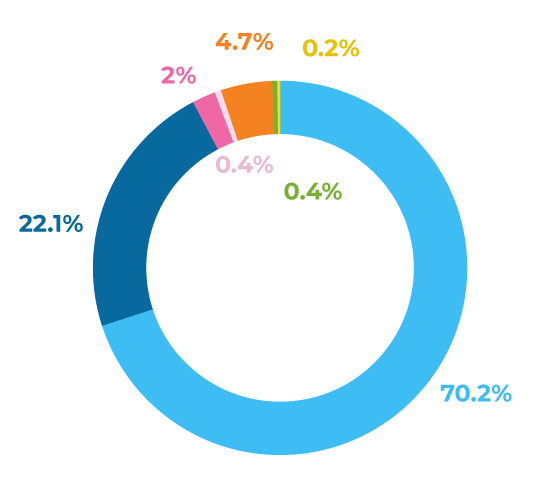

Materials used for packaging and additional material

Relative proportion of materials used for packaging and additional material*

● Paperboard ● Fossil-based polymers ● Plant-based polymers ● Films ● Aluminium foil ● Inks ● Other

*Excluding tab strips, liners and hotmelts

| Materials used by weight (%) | 2024 |

|---|---|

| Renewable materials (paperboard & plant-based polymers) | 72% |

| Non-renewable materials (fossil-polymers, aluminium foil, films & inks) | 28% |

Resource outflows

We are continually improving the circularity of our packages through collaborations to strengthen collection and recycling rates of used beverage cartons (UBCs).

{"chart":{"type":"column"},"title":{"text":" ","align":"left"},"subtitle":{"text":"<p><b>Total amount invested in collection and recycling programmes worldwide (million €)</b><br>\r\n<br>\r\n</p>\r\n<p> </p>\r\n","align":"left"},"yAxis":{"min":0,"title":{"text":"(million €)"}},"tooltip":{},"xAxis":{"crosshair":false,"categories":["Year"],"accessibility":{"description":"Year"}},"legend":{"layout":"horizontal","align":"center","verticalAlign":"bottom"},"series":[{"name":"2022","data":[30.0],"color":"#07699D"},{"name":"2023","data":[40.0],"color":"#F79B40"},{"name":"2024","data":[42.0],"color":"#3DBDF3"}],"exporting":{"buttons":{"contextButton":{"enabled":false}}}}

{"chart":{"type":"column"},"title":{"text":" ","align":"left"},"subtitle":{"text":"<p><b>Total weight of used beverage cartons collected and sent for recycling (kilo tonnes)<sup><span style=\"font-size: 9.0px;\">1</span></sup></b><br>\r\n<br>\r\n</p>\r\n","align":"left"},"yAxis":{"min":0,"title":{"text":"(kilo tonnes)"}},"tooltip":{},"xAxis":{"crosshair":false,"categories":["Year"],"accessibility":{"description":"Year"}},"legend":{"layout":"horizontal","align":"center","verticalAlign":"bottom"},"series":[{"name":"2022","data":[1206.0],"color":"#07699D"},{"name":"2023","data":[1291.0],"color":"#F79B40"},{"name":"2024","data":[1358.0],"color":"#3DBDF3"}],"exporting":{"buttons":{"contextButton":{"enabled":false}}}}

{"chart":{"type":"column"},"title":{"text":" ","align":"left"},"subtitle":{"text":"<p><b> Global collection for recycling rate of used<br />\r\n beverage cartons<sup><span style=\"font-size: 9.0px;\">1</span></sup></b><br />\r\n<br />\r\n</p>\r\n<p> </p>\r\n","align":"left"},"yAxis":{"min":0,"title":{"text":"(rate %)"}},"tooltip":{},"xAxis":{"crosshair":false,"categories":["Year"],"accessibility":{"description":"Year"}},"legend":{"layout":"horizontal","align":"center","verticalAlign":"bottom"},"series":[{"name":"2022","data":[25.0],"color":"#07699D"},{"name":"2023","data":[27.0],"color":"#F79B40"},{"name":"2024","data":[28.0],"color":"#3DBDF3"}],"exporting":{"buttons":{"contextButton":{"enabled":false}}}}

1. The total volume of beverage cartons placed by the entire industry on the market is estimated from externally available industry data and research. The quantity of used beverage cartons collected for recycling is based on the latest official data published or supplied by reliable sources such as governmental bodies, registered recycling organizations, national industry associations, or non-governmental organizations, etc. In cases where such official data is unavailable, the figure is based on our best estimate.

Resource outflows continued

We are committed to the principles of circularity, which play a central role in how we manage and reduce operational waste.

Our goal is to eradicate waste to landfill (and incineration without energy recovery) from our production sites by 2030.*

| Waste (tonnes) | 2022 | 2023 | 2024 | ∆% 2024 vs 2023 |

|---|---|---|---|---|

| Total waste | 192,730 | 184,076 | 177,608 | -4% |

| Non-hazardous waste | 177,354 | 169,537 | 167,671 | -1% |

| Hazardous waste | 15,376 | 14,539 | 9,937 | -32% |

| Total amount of non-recycled waste | 12,914 | 12,422 | 9,669 | -22% |

| Waste management | ||||

| Recycling | 179,816 | 171,654 | 167,939 | -2% |

| Incineration | 11,515 | 10,756 | 8,067 | -25% |

| Landfill | 1,399 | 1,666 | 1,602 | -4% |

*The scope only covers waste that is legally possible to manage without sending to landfill or to incineration without energy recovery. In many places, the local regulations require for example that hazardous waste be sent to landfill or to incineration without energy recovery. This waste is then not in scope for the ‘Zero waste to landfill’ target.

We co-invest with players along the collection and recycling value chain globally, in new technologies, in equipment and in facilities to increase collection, sorting and recycling capacities for used beverage cartons.

| 2022 | 2023 | 2024 | ∆% 2024 vs 2023 | |

|---|---|---|---|---|

| Total amount invested in collection and recycling programmes worldwide (million €) | €30 | €40 | €42 | 5% |

| Total weight of used beverage cartons collected and sent for recycling (kilo tonnes) | 1,206 | 1,291 | 1,358 | 5% |

| Global collection for recycling rate of used beverage cartons1 | 25% | 27% | 28% | |

| Total recyclers Tetra Pak engages with2 | 203 | 211 | 215 | 2% |

| Fibre recycling facilities | 103 | 107 | 113 | 6% |

| PolyAl3 recyclers | 36 | 38 | 39 | 3% |

| Integrated recyclers4 | 61 | 66 | 63 | -5% |

1. The total volume of beverage cartons placed by the entire industry on the market is estimated from externally available industry data and research. The quantity of used beverage cartons collected for recycling is based on the latest official data published or supplied by reliable sources such as governmental bodies, registered recycling organizations, national industry associations, or non-governmental organizations, etc. In cases where such official data is unavailable, the figure is based on our best estimate.

2. Historical numbers for PolyAl and Integrated recyclers have been adjusted vs. previous years, due to an error in Tetra Pak’s FY22 and FY23 Sustainability Report

3. PolyAl = polymer and aluminium

4. Integrated recyclers recycle both fibre and polyAl (separately or together)

CLIMATE

We are working to reduce our environmental impact at every step of the value chain. The food industry has a crucial role to play in mitigating climate change, and we recognise our responsibilities as an advanced manufacturer at the heart of the food system.

See below how we’ve progressed in this area in 2024.

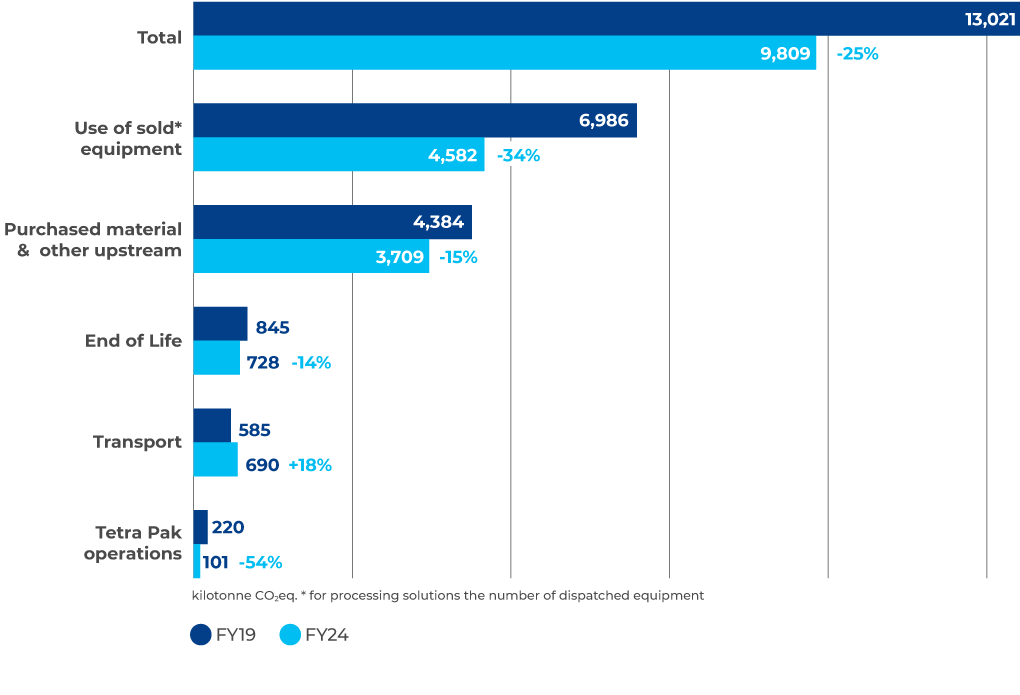

Value chain GHG emissions (k tonnes CO2e)

| Renewable electricity consumption and onsite solar photovoltaics (PV) capacity in Tetra Pak operations | 2019 (baseline) | 2022 | 2023 | 2024 | ∆% 2024 vs 2023 | Target 2030 |

|---|---|---|---|---|---|---|

| Renewable electricity consumption in Tetra Pak operations (%) | 72% | 84% | 89% | 94%1 | 5.6% | 100% |

| Onsite solar photovoltaics (PVs) capacity in megawatts (MW) | 2.7 | 8.47 | 12.7 | 14.7 | 15.7% | - |

1. Assured by EY to the level of limited assurance in 2025. Read more here.

{"exporting":{"buttons":{"contextButton":{"enabled":false}}},"title":{"text":"Renewable electricity consumption","align":"left"},"subtitle":{"text":"<p><b>in Tetra Pak operations</b></p>\r\n","align":"left"},"yAxis":{"title":{"text":"(Percentage %)"}},"xAxis":{"crosshair":false,"categories":null,"accessibility":{"rangeDescription":"Year"}},"legend":{"layout":"horizontal","align":"center","verticalAlign":"bottom"},"plotOptions":{"line":{"legendSymbol":"rectangle"},"series":{"marker":{"symbol":"circle"},"pointStart":2022,"label":{"connectorAllowed":false}}},"series":[{"name":"Percentage (%) renewable electricity <br>consumption inTetra Pak operations","data":[84.0,89.0,94.0],"color":"#07699D"}]}

Climate continued

We are on track to achieve our 2030 GHG emissions target* to reduce absolute scope 1, 2 and 3 GHG emissions by 46% from a 2019 baseline. This follows a further year of progress decarbonising our own operations and helping customers reduce their emissions through the equipment, technology and services we provide.

See further details of this below.

* These targets have been assessed, validated and approved by Science Based Targets initiative. They follow the SBTi Corporate and Near-term Criteria, SBTI Net Zero Standard, and GHG Protocol Corporate standard.

| Tonnes CO2 equivalent |

2019 (baseline)1 | 2022 | 2023 | 20241 | ∆% 2024 vs 2019 | ∆% 2024 vs 2023 |

|---|---|---|---|---|---|---|

| Scope 1 emissions | ||||||

| Direct emissions from owned/controlled operaitons | 64,223 | 59,464 | 48,188 | 42,373 | -34% | -12% |

| Scope 2 emissions | ||||||

| Market-based | 112,770 | 58,187 | 43,339 | 27,841 | -75% | -36% |

| Location-based | 347,221 | 360,588 | 353,323 | 357,246 | 3% | 1% |

| Scope 3 upstream emissions2 | ||||||

| C1: Purchased good and services | 4,330,682 | 3,892,188 | 3,361,715 | 3,683,052 | -15% | 10% |

| C3: Fuel and energy-related Activities (not included in Scope 1 or Scope 2) (Market-based) | 53,630 | 37,494 | 28,920 | 25,568 | -52% | -12% |

| C3: Fuel and energy-related Activities (not included in Scope 1 or Scope 2) (Location-based) | 99,406 | 106,174 | 96,653 | 100,324 | 1% | 4% |

| C4: Upstream transportation and distribution | 548,612 | 649,088 | 531,195 | 642,563 | 17% | 21% |

| C5: Waste generated in operations | 2,742 | 1,762 | 1,974 | 1,932 | -30% | -2% |

| C6: Business travel | 42,987 | 15,288 | 22,364 | 30,535 | -29% | 37% |

| Scope 3 downstream emissions | ||||||

| C9: Downstream transportation and distribution2 | 36,317 | 40,756 | 37,062 | 47,032 | 30% | 27% |

| C11: Use of sold products3 | 6,986,498 | 6,823,596 | 5,654,918 | 4,582,011 | -34% | -19% |

| C12: End-of-life treatment of sold products | 842,122 | 814,692 | 798,632 | 725,633 | -14% | -9% |

| Total Scope 3 (market-based) | 12,843,591 | 12,274,863 | 10,436,780 | 9,738,327 | -24% | -7% |

| Total GHG emissions (market-based) | 13,020,594 | 12,392,515 | 10,528,307 | 9,808,541 | -25% | -7% |

| Emissions intensity (market-based tonnes CO2e / revenue in million €) | 1,137 | 992 | 825 | 765 | -33% | -7% |

1. Assured by EY to the level of limited assurance in 2025. Find the assurance statement here.

2. Categories excluded due to limited impact = 2(capital goods and service), and 7 (employee commuting). Categories excluded due to not being relevant to Tetra Pak = 8 (upstream leased assets), 14 (franchises), and 15 (investments).

3. Categories 10 (processing of sold products) and 13 (downstream leased assets) are included within category 11.

| 2019 (baseline) | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Biogenic CO2 emissions and removals (metric kilotonnes CO2) | ||||

| Direct biogenic CO2 emissions from combustion of bio-based fuels | 1.62 | 1.61 | 1.86 | 1.82 |

| Indirect biogenic CO2 emissions from landfills and incineration without energy recovery | 156 | 151 | 152 | 135 |

| Indirect biogenic CO2 removals referring to the biogenic content of the raw materials purchased | 2,781 | 3,040 | 2,737 | 2,840 |

In 2024, we continued the roll out of our Common Energy Monitoring Platform (CEMP), using our technology and data visualisation expertise to understand and manage our energy consumption on a global level. As a result, 98% of our manufacturing energy consumption is now monitored via CEMP, enabling identification, measurement and verification of completed energy efficiency projects.

Below shows details of our energy consumption and mix.

| Energy consumption and mix | 2019 | 2022 | 2023 | 2024 | ∆% 2024 vs 2023 |

|---|---|---|---|---|---|

| Energy consumption – Fossil sources (MWh) | 512,895 | 402,582 | 292,405 | 238,844 | -18% |

| Coal & coal products | 598 | 0 | 0 | 0 | - |

| Crude oil and petroleum products | 44,926 | 40,531 | 38,586 | 33,832 | -12% |

| Natural gas | 244,209 | 231,113 | 151,443 | 144,172 | -5% |

| Other fossil sources | 0 | 0 | 0 | 0 | - |

| Purchased or acquired heat from fossil sources | 223,162 | 130,938 | 102,376 | 60,839 | -41% |

| Energy consumption – Renewable sources (MWh) | 603,883 | 746,376 | 772,675 | 826,723 | 7% |

| Biomass, biofuels, biogas, hydrogen from renewable sources | 8,017 | 7,961 | 9,140 | 8,960 | -2% |

| Acquired electricity, heat, steam or cooling from renewable sources | 593,738 | 723,581 | 753,053 | 804,427 | 7% |

| Self-generated non-fuel renewable energy | 2,127 | 5,834 | 10,481 | 13,336 | 27% |

| Total energy consumption (MWh) | 1,116,777 | 1,148,958 | 1,065,080 | 1,065,567 | 0% |

| Share of non-renewable energy consumption | 46% | 35% | 27% | 22% | |

| Share of renewable energy consumption | 54% | 65% | 73% | 78% | |

| Energy production (MWh) | 28,673 | 26,840 | 11,261 | 13,934 | 24% |

| Non-renewable energy production | 26,545 | 21,007 | 779 | 599 | -23% |

| Renewable energy production | 2,127 | 5,834 | 10,481 | 13,336 | 27% |

| Energy intensity from activities in high climate impact sectors1 (MWh/ million €) | 98 | 92 | 84 | 83 | -0.5% |

1. Energy Intensity is based on the total 2024 energy consumption and revenues. All consumed energy is associated with activities in high climate impact sectors “NACE Code C – Manufacturing” and “NACE Code G - Wholesale and Retail Trade"

NATURE

Aligned with Target 15 of the Global Biodiversity Framework, we have conducted a detailed assessment to identify the impacts and dependencies of our own operations and value chain on nature. We’ve also identified biodiversity & ecosystems, water management, and pollution to air and water as material topics for our business.

See below how we’ve progressed in this area in 2024.

Water

{"exporting":{"buttons":{"contextButton":{"enabled":false}}},"title":{"text":"Total water consumption from all areas over time","align":"left"},"subtitle":{"text":null,"align":"left"},"yAxis":{"title":{"text":"(Megaliteres)"}},"xAxis":{"crosshair":false,"categories":null,"accessibility":{"rangeDescription":"Year"}},"legend":{"layout":"horizontal","align":"center","verticalAlign":"bottom"},"plotOptions":{"line":{"legendSymbol":"rectangle"},"series":{"marker":{"symbol":"circle"},"pointStart":2022,"label":{"connectorAllowed":false}}},"series":[{"name":"Water consumption","data":[1013.0,905.0,852.0],"color":"#3DBDF3"}]}

{"chart":{"type":"pie","chartType":"pie"},"title":{"text":"Share of water withdrawal by Tetra Pak function","align":"center"},"subtitle":{"text":null,"align":"left"},"tooltip":{"pointFormat":"'{series.name}: <b>{point.percentage:.1f}%</b>"},"series":[{"name":"Share of water withdrawal by Tetra Pak function","colorByPoint":true,"data":[{"name":"Packaging material converting","y":77.0,"color":"#07699D"},{"name":"Additional material production","y":9.0,"color":"#B9E5FB"},{"name":"Machines & equipment assembly","y":13.0,"color":"#78B032"},{"name":"Offices & support functions","y":2.0,"color":"#F58220"}]}],"legend":{"layout":"horizontal","align":"center","verticalAlign":"bottom"},"exporting":{"buttons":{"contextButton":{"enabled":false}}}}

We work to reduce the use of freshwater across our production sites through applying solutions such as optimising cooling systems, irrigation and domestic water systems, rainwater harvesting, water reuse and circulation.

See further details of our water metrics below.

| Water metrics (megalitres) | 2019 (baseline)1 | 2022 | 2023 | 20241 | ∆% 2024 vs 2019 | ∆% 2024 vs 2023 | Target 2023 |

|---|---|---|---|---|---|---|---|

| Total water withdrawal from all areas in scope of water target | 2,066 | 1,938 | 1,914 | 1,708 | -17% | -11% | -35%2 |

| Total water withdrawal from all areas | 2,121 | 2,505 | 2,470 | 2,316 | -6% | ||

| Surface water | 78 | 531 | 537 | 578 | 8% | ||

| Ground water | 605 | 476 | 508 | 442 | -13% | ||

| Seawater | - | - | - | - | |||

| Produced water | - | - | - | - | |||

| Third-party water | 1,435 | 1,498 | 1,425 | 1,296 | -9% | ||

| Total water withdrawal from areas with water stress | 976 | 1,015 | 945 | 898 | -5% | ||

| Surface water | 78 | 0 | 3 | 5 | 67% | ||

| Ground water | 245 | 223 | 186 | 175 | -6% | ||

| Seawater | - | - | - | - | - | ||

| Produced water | - | - | - | - | - | ||

| Third-party water | 651 | 792 | 756 | 718 | -5% | ||

| Total water discharge to all areas | 1,145 | 1,491 | 1,566 | 1,463 | -7% | ||

| Surface water | No data | 637 | 685 | 706 | 3% | ||

| Ground water | No data | 43 | 3 | 3 | 0% | ||

| Seawater | - | ||||||

| Third-party water | No data | 811 | 855 | 735 | -14% | ||

| Total water consumption from all areas | 976 | 1,013 | 905 | 852 | -6% | ||

| Water consumption in areas with water stress | 571 | 575 | 532 | 528 | -1% | ||

| Water intensity (m3 consumption per m€ revenue) | 85 | 81 | 71 | 66 | -22% | -6% | |

| CDP score for Water | - | - | A- | A- |

1. Assured by EY to the level of limited assurance in 2025. Find the assurance statement here

2. Our water withdrawal target is broken down per production site with specific targets given to each site depending on their level of water risk. With our site-based targets we aim to achieve a 35% water withdrawal reduction across Tetra Pak production sites by 2030 compared to 2019.

Accounting principles:

For classification of water withdrawal from areas with water stress the WRI Aqueduct tool has been used and site coordinates have been entered into it. We have used ‘Baseline water stress’ (BWS) as an indicator and water stressed areas are those rated ‘High’ or ‘Extremely high’ for BWS.

Biodiversity and ecosystems

{"exporting":{"buttons":{"contextButton":{"enabled":false}}},"title":{"text":"Cumulative land and under restoration over time","align":"left"},"subtitle":{"text":null,"align":"left"},"yAxis":{"title":{"text":"Hectares"}},"xAxis":{"crosshair":false,"categories":null,"accessibility":{"rangeDescription":"Year"}},"legend":{"layout":"horizontal","align":"center","verticalAlign":"bottom"},"plotOptions":{"line":{"legendSymbol":"rectangle"},"series":{"marker":{"symbol":"circle"},"pointStart":2022,"label":{"connectorAllowed":false}}},"series":[{"name":"Land under restoration","data":[87.0,272.0,1564.0],"color":"#3DBDF3"}]}

| 2022 | 2023 | 2024 | ∆% 2024 vs 2023 | Target 2030 | |

| Cumulative land under restoration through Araucaria Conservation programme in the Brazilian Atlantic Forest (hectares) since 2022 | 87 | 272 | 1,564 | 475% | 7,000 ha |

| CDP score for Forests | A | A | A- | N/A | N/A |

The Araucaria Conservation Programme is our first initiative to restore rural land in the Atlantic Forest in Brazil using native species. The project aims to benefit local communities, the flora and fauna in the region, and global efforts to promote biodiversity and combat climate change. Read more here.

Nature continued

We are working to reduce air pollution from our flue gas emissions in the manufacturing stage, with a focus on volatile organic compounds (VOCs).

To reduce VOCs that arise from solvents used in printing plate preparation at our packaging material converting factories, we developed our ‘solvent free pre-press’ technique. It reduces VOCs by an estimated 99%. This process has now been rolled out to nine factories with positive results across all sites.

See further details of our air pollution metrics below.

| Air pollution metrics (tonnes) | 2019 (baseline) | 2022 | 2023 | 2024 | ∆% 2024 vs 2023 |

|---|---|---|---|---|---|

| Total VOC emissions in packaging production | 1,068 | 637 | 493 | 414 | -16% |

| Reduction in solvent emissions in own operations through production process improvements (%) | - | - | 29% | 27% | - |

We strive to improve the livelihoods of people across the world by giving access to safe food, contributing to economic growth, and respecting human rights in our workplaces, our value chain and the communities we operate in.

See below how we’ve progressed in our performance in this area in 2024.

Our ambition is to have a workplace where every employee is respected, included, engaged, offered fair opportunities and treated equally, irrespective of their background.

See further details about our employee numbers

| 2022 | 2023 | 2024 | ||||

| Total number and share of employees | 24,370 | 24,814 | 24,954 | |||

| Female | 5,630 | (23%) | 5,895 | (24%) | 6,107 | (24%) |

| Male | 18,740 | (77%) | 18,919 | (76%) | 18,847 | (76%) |

| Contract type1 | ||||||

| Total number of permanent employees | - | 24,297 | 24,443 | |||

| Female | - | 5,692 | 5,914 | |||

| Male | - | 18,605 | 18,529 | |||

| Total number of temporary employees | - | 254 | 259 | |||

| Female | - | 76 | 63 | |||

| Male | - | 178 | 196 | |||

| Total number of non-guaranteed hours employees | - | 263 | 252 | |||

| Female | - | 127 | 130 | |||

| Male | - | 136 | 122 | |||

| Employee turnover | ||||||

| Employees who left Tetra Pak (number) | 3,384 | 2,488 | 2,463 | |||

| Rate of employee turnover | 13.7% | 10.1% | 9.9% | |||

| Employee engagement survey results2 | ||||||

| Employee Engagement score (%) | - | - | 87% | |||

| Employee Engagement Participation rate (%) | - | - | 85% | |||

1. Data before 2023 is not available due to changes in category definitions, meaning historical data before 2023 would not be comparable with 2023 and 2024 data.

2. No historical data shown due changes in methodology and platform used to collect Employee Engagement results in 2024. While we do have historical results related to Employee Engagement, these results would not be fully comparable with the 2024 results.

| Female | Male | Total | |

|---|---|---|---|

| Argentina | 72 | 370 | 442 |

| Brazil | 388 | 1,142 | 1,530 |

| China | 523 | 1,984 | 2,507 |

| Denmark | 97 | 425 | 522 |

| France | 166 | 487 | 653 |

| Germany | 146 | 645 | 791 |

| Hungary | 158 | 300 | 458 |

| India | 239 | 1,308 | 1,547 |

| Italy | 507 | 1,238 | 1,745 |

| Japan | 101 | 500 | 601 |

| Mexico | 227 | 888 | 1,115 |

| Netherlands | 53 | 243 | 296 |

| New Zealand | 58 | 193 | 251 |

| Pakistan | 32 | 310 | 342 |

| Panama | 186 | 142 | 328 |

| Poland | 94 | 354 | 448 |

| Saudi Arabia | 9 | 249 | 258 |

| Serbia | 119 | 264 | 383 |

| Singapore | 95 | 173 | 268 |

| Spain | 185 | 601 | 786 |

| Sweden | 1,151 | 2,473 | 3,624 |

| Switzerland | 89 | 166 | 255 |

| Thailand | 141 | 314 | 455 |

| Türkiye | 68 | 299 | 367 |

| United States | 372 | 1,304 | 1,676 |

| Vietnam | 102 | 408 | 510 |

1. Per country with 250 employees or more representing at least 10% of Tetra Pak’s total number of employees

In our latest large-scale employee engagement survey, we achieved diversity and inclusion engagement survey results 10% higher than the manufacturing industry average in 2024, highlighting our commitment to fostering an inclusive workplace where diversity is valued and celebrated.

See additional detail on our diversity metrics below.

Total number and share (%)

2022 |

2023 |

2024 |

||||

|---|---|---|---|---|---|---|

| Tetra Laval Board1 | ||||||

| Female | 1 | (12%) | 1 | (22%) | 0 | (0%) |

| Male | 8 | (88%) | 8 | (88%) | 8 | (100%) |

| Executive Leadership Team (ELT) | ||||||

| Female | 1 | (10%) | 1 | (10%) | 2 | (18%) |

| Male | 9 | (90%) | 9 | (90%) | 9 | (82%) |

| Senior Management2 | 114 | 118 | ||||

| Female | - | - | 29 | (23%) | 32 | (27%) |

| Male | - | - | 85 | (77%) | 86 | (73%) |

| Age split for all employees | 24,370 | 24,814 | 24,954 | |||

| Below 30 years | 2,552 | (10%) | 2,868 | (12%) | 2,905 | (12%) |

| 30-50 years | 15,270 | (63%) | 16,057 | (65%) | 16,007 | (64%) |

| Above 50 years | 6,327 | (26%) | 5,889 | (24%) | 6,042 | (24%) |

1. TLG Board members are non-executive and independent.

2. Senior management is defined as Tetra Pak employees in the Executive Leadership Team (which includes our President and CEO & Direct Leader Reports), and ELT -1, excluding Administrative Assistance. Metrics calculated using end-of-period Headcount as of December 31 of the reporting year. The way we define and measure the number of employees in 'senior management' positions changed in 2023, hence, 2022 data is not comparable with 2023-2024 data and not reported.

At Tetra Pak, our goal is to create a culture of continuous improvement with our employee learning and development programmes. We encourage curiosity, exploration and a growth mindset in all our colleagues.

Further details on our training and skills metrics are below.

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Training and skills development1 | |||

| Average number of training hours per employee | 18.7 | 18.6 | 17.1 |

| Female | 15.4 | 15.2 | 13.9 |

| Male | 19.7 | 19.7 | 18.1 |

| Total workforce who received career- or skills-related training (%)2 | 81% | 88% | 79% |

| Career management | |||

| Employees that participated in regular performance and career development reviews (%) | 100% | 100% | 100% |

| Number of employees with personal development plans3 | 1,908 | 4,836 | 5,381 |

| Number of internal mobility cases | 4,905 | 4,587 | 3,944 |

1. Training hours are captured from multiple learning systems and include all types of training available at Tetra Pak. The training hours of an employee that left the company before December 31st 2024 are excluded from the calculation, as are trainings performed by consultants.

2. At Tetra Pak, all employees have access to a wide range of training opportunities. While participation is not mandatory, training is actively promoted and encouraged on a voluntary basis. The data disclosed reflect the percentage of employees who completed career- or skills-related training during the reporting period

3. At Tetra Pak we do not have a yearly cycle to close a personal development plan. For this reason, historical data provided for years 2022-2023 is based on an extract from February, 2025.

We are committed to ensuring the health and safety of employees, contractors, visitors and anyone affected by our operations on our own sites or others we operate.

See details of these metrics below.

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Total fatalities (including contractors) | 0 | 0 | 0 |

| Number of employee recordable work-related accidents | 121 | 104 | 94 |

| Total recordable accident rate (TRAR)1 | 2.1 | 1.82 | 1.63 |

| Number of employees covered with health care | - | - | 19,888 |

| Share of manufacturing sites ISO 45001 certified | 96% | 96% | 96% |

1. Total recordable accident rate = (number of recordable accidents) / work hours x 1,000,000.

BUSINESS CONDUCT

We are committed to conducting every aspect of our business with integrity, complying with the rule of law and respecting human rights across our operations and value chain in line with the UN Guiding Principles on Business and Human Rights (UNGPs).

We expect the same level of ethical business conduct within our own operations and among the companies we do business with, including suppliers.

See below how we’ve progressed in our performance in this area in FY24.

Tetra Pak has an established and well-defined Corporate Governance Framework guiding how we conduct business. Everything that we do as a company – developing strategy, taking decisions, and defining how we operate and act – is guided by this framework which helps us to comply with relevant regulations and legislation and guides us to behave ethically and responsibly.

All employees are responsible for fulfilling the principles of our Corporate Governance Framework in their everyday roles. Mandatory trainings are provided to employees to ensure that the highest governance standards are met. By providing the foundation for our strategy and approach to leadership, good governance ultimately helps us fulfil our vision to commit to making food safe and available, everywhere and deliver on our brand promise to PROTECT WHAT’S GOODTM. Read more here.

See further metrics related to the issue below.

| Business ethics metrics | 2022 | 2023 | 2024 |

|---|---|---|---|

| Total workforce trained on business ethics issues (%) | 97% | 98% | 98% |

| Operational sites for which an internal audit/risk assessment concerning business ethics issues has been conducted (%) | 100% | 100% | 100% |

| Number of confirmed information security incidents | 0 | 0 | 0 |

| Operational sites with an information security management system (ISMS) certified to ISO 27000 | 1 (Türkiye) | 1 (Türkiye) | 1 (Türkiye) |

| Number of child or forced labour incidents within own workforce reported | 0 | 0 | 0 |

We prioritise building strong, sustainable and ethical relationships with our suppliers.

Our approach is guided by comprehensive procurement policies and procedures and a commitment to continuous improvement, ensuring that our procurement processes align with our sustainability goals and ethical standards.

To accelerate collaboration with our suppliers, we launched our flagship initiative ‘Join Us in Protecting the Planet’ (JUIPP) four years ago. It asks suppliers to identify ways to reduce their GHG emissions, assess and address their impact on nature, maximise the use of recycled content and address human rights impacts, and more.

At Tetra Pak, we require our suppliers to uphold the standards outlined in the Tetra Pak Code of Business Conduct for Suppliers (the Supplier Code), consisting of 15 fundamental principles. Read more here.

Below features further details around this.

| Sustainable procurement | 2024 |

|---|---|

| Suppliers committed to Tetra Pak’s Supplier Code of Conduct (%) | 97% |

| High-risk category/ strategic suppliers undergoing ESG assessments | 100% |

| High-risk category/ strategic suppliers undergoing on-side audit | 82% |

| High-risk category/ strategic suppliers engaged in corrective actions or capacity building | 6 |

| Procurement staff trained on sustainable procurement topics (%) | 91% |

| Join us In Protecting the Planet (JUIPP) Supplier Sustainability Initiative | |

| Number of suppliers involved in JUIPP | 147 |

| Base material suppliers | 43 |

| Spend coverage of base materials suppliers (%) | 99% |

| Equipment & services suppliers | 104 |

| Spend coverage of equipment and services suppliers (%) | 40% |

SOCIAL SUSTAINABILITY